Medicare Advantage

We offer all Med-Advantage plans available in KC and St. Louis metro areas

Medicare Advantage Plans we work with include:

United Healthcare, Blue Cross Blue Shield of KC, Cigna Healthspring, Aetna, Humana, Mutual of Omaha, BCBS Anthem (St. Louis)

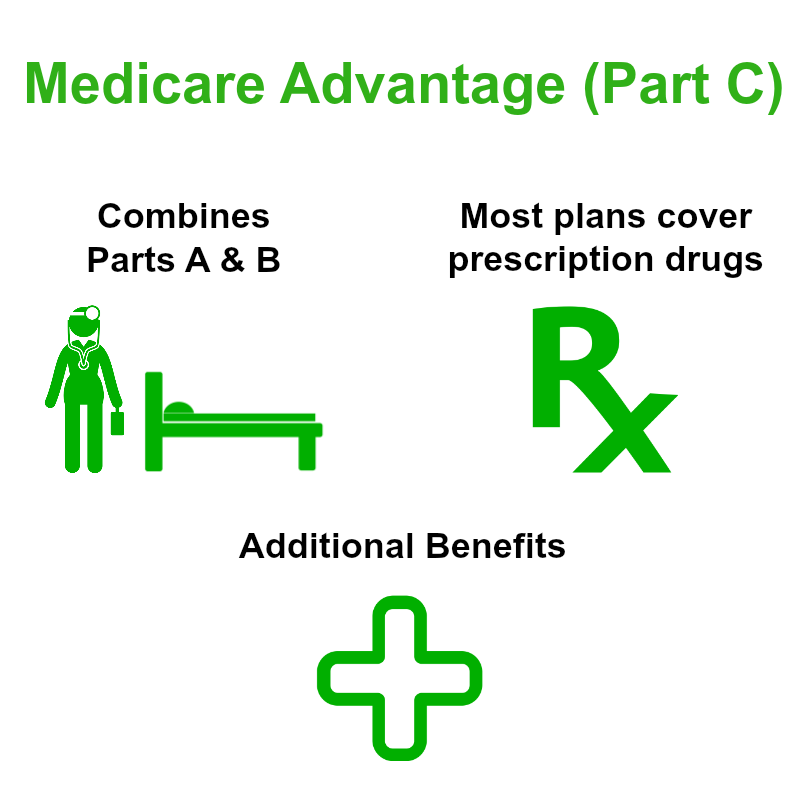

What is Medicare Advantage (Medicare Part C)?

Medicare Advantage, known as Medicare Part C, combines coverage for hospital costs, doctor visits, and other medical services. Often Medicare Part C covers prescription drug costs and can include benefits, such as routine vision, hearing, dental, and wellness services. Medicare Part C coverage is more extensive than Parts A and B and can provide a well-rounded coverage solution. Enrollment begins the month of your 65th birthday and ends three months afterward.

Medicare Advantage, known as Medicare Part C, combines coverage for hospital costs, doctor visits, and other medical services. Often Medicare Part C covers prescription drug costs and can include benefits, such as routine vision, hearing, dental, and wellness services. Medicare Part C coverage is more extensive than Parts A and B and can provide a well-rounded coverage solution. Enrollment begins the month of your 65th birthday and ends three months afterward.

Medicare Advantage Plans -

The cost for Medicare part C coverage depends on the provider you choose. They are a pay as you go plan. You must continue to keep Part B of Medicare and pay your premiums after enrollment in Medicare Advantage health plans. Medicare Part C plans limit the amount of out-of-pocket you have to spend and there is a possibility of a coverage gap if you have prescription drug coverage. Otherwise, the deductibles, copays, and coinsurance charges and rules vary by each Medicare Advantage plan provider.

Depending on Medicare Advantage plans, you will be able to choose a primary care doctor or you can go to any Medicare-eligible provider who accepts your Part C Medicare plan terms. Each plan has a specific service area that includes the Medicare Part C coverage that you are limited to, unless emergency health care is required out of the coverage area.

Medicare Advantage Plan Eligibility

To be eligible for Medicare Advantage plans, you have to be enrolled in Parts A and B and live in the plan’s service area. If you have joined Parts A and B, you cannot be denied coverage as long as the plan is accepting new members. A Medicare Advantage plan is not affected by health or finances. The only exception is those who have end-stage renal disease (ERSD) may be denied coverage.